QUIZ AA025

ACCOUNTING 2

TOPIC 7:

ABSORPTION COSTING AND MARGINAL COSTING

Jingga Sdn Bhd (JSB) is a product manufacturer known as PROP which is sold for RM30 per unit. In 2023, JSB issued 67,500 units of the PROP where 49,500 units were sold. Information on production operations is as follows:

(Jingga Sdn Bhd (JSB) adalah pengeluar produk yang dikenali sebagai PROP, dijual pada harga RM30 seunit. Pada 2023, JSB telah mengeluarkan 67,500 unit PROP dimana 49,500 unit telah dijual. Maklumat berkaitan operasi pengeluaran adalah seperti berikut:)

|

Item |

RM |

|

Beginning

inventory

(Inventori

awal)

|

0 |

|

Direct material (Bahan

langsung)

|

472,500

|

|

Direct labor

(Buruh

langsung)

|

405,000 |

|

Variable

overhead

(Overhed

berubah)

|

202,500

|

|

Fixed overhead

(Overhed

tetap)

|

270,000 |

|

Fixed selling

expenses (Belanja jualan tetap)

|

69,600 |

|

Fixed

administration expenses

(Belanja pentadbiran tetap)

|

104,400 |

|

Sales

commission per unit

(Komisen jualan seunit)

|

3 |

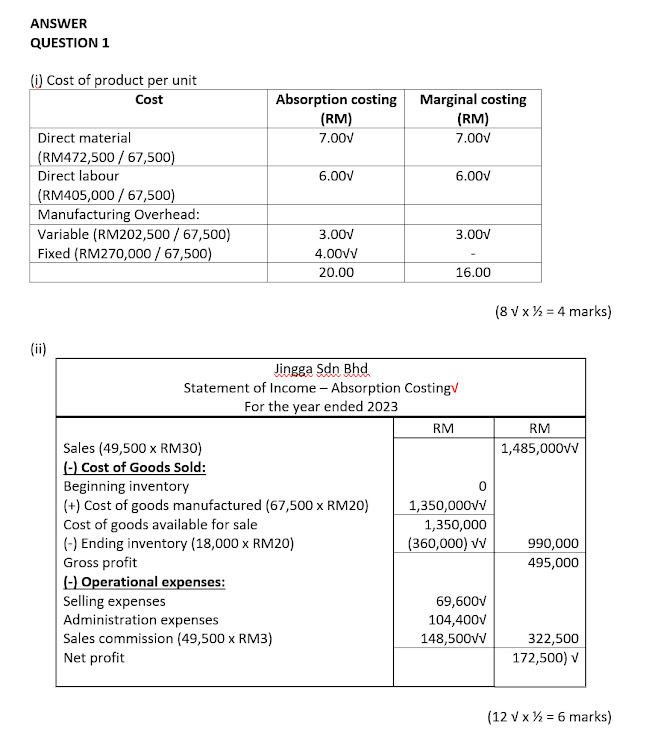

REQUIRED:

(i)

Calculate the product cost per unit based on the absorption

costing method and marginal costing method.

(Kirakan kos produk seunit berasaskan kaedah pengekosan serapan

dan kaedah pengekosan marginal.)

(ii)

Show income statement based on marginal costing and absorption

costing method for year ended 2023.

(Tunjukkan penyata pendapatan berasaskan kaedah pengekosan serapan

dan kaedah pengekosan marginal bagi tahun berakhir 2023.)

QUESTION 2 (22 MARKS)

Syarikat Sinar uses normal costing system to allocate

overhead costs. The company's normal production is 12,000 units per year.

Estimated overhead costs for a year are as follows:

(Syarikat Sinar menggunakan sistem pengekosan normal bagi memperuntukkan kos overhed. Pengeluaran normal syarikat adalah 12,000 unit setahun. Anggaran kos overhed bagi setahun adalah seperti berikut :)

(Syarikat Sinar menggunakan sistem pengekosan normal bagi memperuntukkan kos overhed. Pengeluaran normal syarikat adalah 12,000 unit setahun. Anggaran kos overhed bagi setahun adalah seperti berikut :)

|

Variable overhead (Overhed berubah)

|

RM30,000 |

|

Fixed

overhead (Overhed tetap)

|

RM120,000 |

The actual operational information for 2023 is as

follows:

(Maklumat sebenar

operasi bagi tahun 2023 adalah seperti berikut :)

INSTRUCTIONS:

|

Beginning

inventory

(Inventori

awal)

|

1,000 units |

|

Unit of

production

(Unit keluaran)

|

10,000 units |

|

Unit of

sales

(Unit jualan)

|

8,500 units |

|

Direct material

per unit

(Bahan mentah langsung seunit)

|

RM10 |

|

Direct labor

per unit

(Buruh langsung seunit)

|

RM5 |

|

Variable

overhead per unit

(Kos overhed berubah seunit)

|

RM2.50 |

|

Fixed overhead

cost

(Kos overhed tetap)

|

RM90,000 |

|

Seling price

per unit

(Harga jualan seunit)

|

RM50 |

|

Variable

selling and administrative expenses per unit

(Belanja jualan dan pentadbiran berubah seunit)

|

RM5 |

|

Fixed selling and administrative expenses

(Belanja jualan dan pentadbiran tetap)

|

RM85,000 |

INSTRUCTIONS:

(i)

Show a Income Statement

for 2023 using marginal costing and absorption costing.

(Tunjukkan Penyata Pendapatan bagi tahun 2023 dengan menggunakan kaedah pengekosan marginal dan pengekosan

serapan.)

(ii)

Show adjustment the net

profit difference between the two costing methods.

(Tunjukkan pelarasan

perbezaan untung bersih diantara kedua-dua kaedah.)

![madamfizi.com [HOME]](https://blogger.googleusercontent.com/img/a/AVvXsEiapPdfrHpAILaSqgRr5e2dWKt0j9ttGJeVBLAYz0i33KG6rjtseOW-FXH5OZUUTkWGyQb5sA-nZmhdN6iOtznaTHhsgqOiEajnySChNUJgnw3g0wKWIQqVoF6ZaZ_-O0mCiUA6OlV9DoPnIzZcJtshOFFspfwKW9eXqAIYVSxuSUIyF0b0eCk7k-_m=s588)